Did you look at the title, then look for the name of the Author and ask – how could a Chartered Accountant, a Public Speaker and Trainer at that make such a blatant spelling mistake? Or did you think, “There must be something different about this?” Or did you even notice? Most of us Chartered Accountants are trained to be detail oriented, and spend too much time sweating over the small stuff.

But have you ever wondered why and how some organizations, don’t sweat the small stuff, and continue to remain at the top of the heap regardless of worldwide recession, man-made disasters or natural calamities?

And why some others, seemingly financially strong, sink without a trace or are badly mauled when the tsunami of economic woes hits with all its fury? And when this happens, the best employees, the greatest yet most undervalued asset of any organization, either are dumped as the ship sinks or intelligently make their way to the former set of organizations………… or become entrepreneurs or self-employed!

The answer is very simple – the former set of organizations knows the Cecrets to Sustainable Profitability and Growth, what I call Financial Leadership & Excellence. Examples of these organizations are GE, Toyota, Dell, and Infosys. On the other end of the spectrum are companies that failed miserably on the test of Financial Leadership & Excellence – Enron and Satyam just to say a few.

This concept is equally applicable to small and medium organizations as with the large companies. During the recent economic tsunami that hit the world and more particularly, Dubai, a number of large, medium and small organizations that looked very profitable and successful have vanished from the economic landscape while others have survived, barely so. We do not have to look very far and wide to see examples of this phenomenon.

A case in example is a company that I closely worked with between 1998 and 2008. Within a few months of joining the organization, the share price nose-dived after the announcement of financial irregularities. This resulted in large scale lay-offs, reduction in costs and significant erosion of profits. Needless to say, soon enough there was a change in Management. The new CEO of the organization realized the need for a change in organizational culture shifting the focus from short-term profitability to long-term sustainability. By 2008, the company’s share price had increased 300% from 1998 levels. The recent economic downturn affected the share price but given the strong foundation of the organization culture, the share price rebounded and has made significant gains. Very simply, the company moved from short term Financial Leadership focus in 1998 to long term Financial Excellence and by 2008 was reaping the benefits of this change.

What is Financial Leadership & Excellence?

Financial Leadership is defined as the ability of an organization to inspire confidence amongst its stakeholders for better financial returns.

The 5 C’s of Financial Leadership indicate the ability of the organization to:

- Generate positive operational Cash flow at all times

- Drive higher Customer satisfaction resulting in Increased revenue

- Control and manage Risks effectively thus deliver predictable results and lower costs

- Improve Cyclical velocity resulting in higher returns on assets and inventory, lower receivable days

- Create value for the Shareholders

Financial Excellence is defined as the ability of an organization to sustain Financial Leadership over successive business cycles.

Organizations achieve this through the 5 C’s of Financial Excellence:

- Core Values, Vision & Strategy – Values that guide the organization and its people in its conduct internally and externally

- Competence – Actively working towards improving the competence of its People, Processes and Technology

- Compliance – Ensuring that the organization and its people comply with the Laws of the Land that it operates in and also internally to the organization’s Core Values

- Communication – Epitomizes the highest level of Communication internally within the organization and externally to stakeholders

- Commitment – The Management shows and expects Commitment to Financial Excellence, both internally and externally

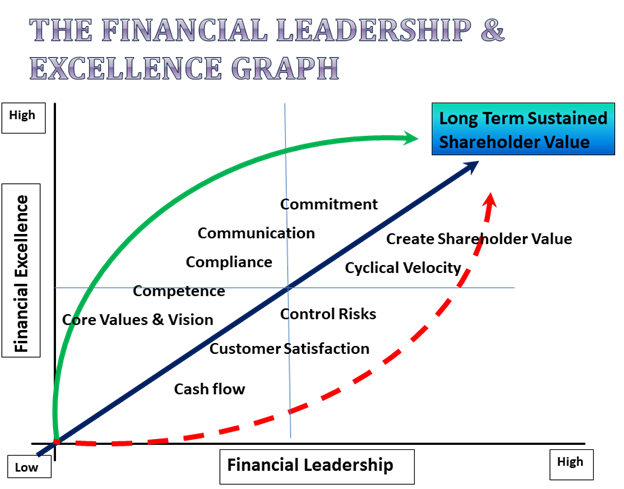

Look at the following graph.

Typically, most organizations follow the path along the red line through their life-cycle. They aim to achieve Financial leadership, aiming at cash flows, profitability and growth without much attention to Excellence. The key focus is on organizational effectiveness, measured by increasing revenue; focus on profits and balance sheet growth. While they focus on short term success, these organizations also have chronic high employee turnover, constant change in strategy to meet short term needs, and a dubious record of compliance in the absence of clear Core Values and Vision. When tragedy strikes in the form of an economic downturn, these organizations suffer significantly due to weak foundation on which the business is based. Employees quit like rats abandoning a sinking ship, revenue and profitability are eroded and shareholder value suffers. Those organizations that survive the downturn then realize the need for a values based organization and long term strategy leading to a drive towards Excellence.

Few organizations follow the path along the green line. This alternative path of trying to achieve Financial Excellence takes a long term view of business. The management of such organizations establishes strong Core values early on in the organization’s life-cycle. Though profitability and financial growth is important, it is not the only criteria for business decisions. Consequently, these organizations may struggle for financial stability initially. If economic downturn strikes early in the life-cycle of the organization, these organizations also suffer dramatically due to poor financial results and pressures of the market to deliver results. Sometimes, the management in such cases is unable to sustain business. Organizations such as these that survive the downturn show a fast recovery and higher than expected financial return due to strong employee morale and a sound foundation of business principles.

The ideal scenario is for organizations to strike a balance between Financial Leadership & Excellence and grow the organization along the blue line. Though easier said than done, the recent economic events clearly dictate the need for:

- a strong foundation of Core Values and Vision;

- Competent people driving Compliance with External Laws and internal Values

- a combination of effective Communication and Commitment.

Business Plans drawn up for such organizations should be critically examined for a long term view and the ability to be funded, internally or externally, during the early days to ensure financial success. Organizations that adopt the ideal path are most likely to succeed in the long term while continuing to meet short term objectives.

If you have read this article this far, then I ask you three questions –

- Where is your organization on the path to Financial Leadership & Excellence?

- Can your organization achieve Financial Leadership & Excellence?

What can you do?

Shridhar Sampath

Professional Speaker, Business Coach & Trainer

Shridhar Sampath is a Speaker, Business Coach and Business & Financial skills Trainer. His company Motivaluate Consulting & Training FZ LLC helps organizations, business owners and future decision makers achieve Sustainable Profitability and Growth by Inspiring, Challenging and Educating them on Better Business Decisions. Until recently, he was the Eastern Hemisphere Financial Controller of an International Organization. Shridhar is an ACA and a CPA.